In the 1st article of our series "KPIs for Product Managers" we described the importance of KPIs: "Key Performance Indicators (KPIs)". The following article should help defining KPIs.

Categorization of KPIs

Basically, KPIs can be categorized in different ways. The simplest categorization differentiates between internal and external or product performance and operative criteria. Often these categories are not granular enough. We have found the following categorization in many companies and have applied it:

- Financial and corporate key figures (e.g. margin, costs, total sales, EBT, EBIT, EBIT-margin, ...)

- Key sales figures (e.g. sales by sales channel, region: target, forecast, actual, sales pipeline by sales phase, average deal size, average sales cycle, conversion rate of the individual sales phases, ...)

- Market key figures (e.g. market growth, growth of competitors, growth of correlated or dependent markets, etc.)

- Marketing key figures (e.g. number of leads, brand awareness, costs per lead, web key figures: traffic, origin of traffic, duration of stay, conversion)

- Product key figures (e.g. product quality, support key figures: number of support cases, duration and costs per case until solution, development agility: velocity, story points per iteration, burn down charts, costs: use of goods, employee costs, apportionment costs)

Consolidation of KPIs should take place across the product, an entire product line or portfolio, an entire division or individual sales channels, depending on the granularity and business purpose.

Defining KPIs which are SMART

Each KPI must be assigned a target or target corridor and must be SMART:

- Sustainable & Specific: sustainable (for business) & specific (precisely defined)

- Measureable

- Achievable, Accepted & Actionable: achievable - attainable, accepted by the teams, provided that it concerns concrete goals, actionable - traceable, in the sense of "measures for control" are derivable and executable

- Reasonable, Realistic: reasonable - comprehensible, realistic (for KPI's that correspond to goals)

- Time based: one underlying period, one comparison period and one target period

The so defined KPIs are provided with a target value. Particularly in the case of key sales figures, they are compared with the target value and the achievement of the target is predicted, i.e. "forecasted".

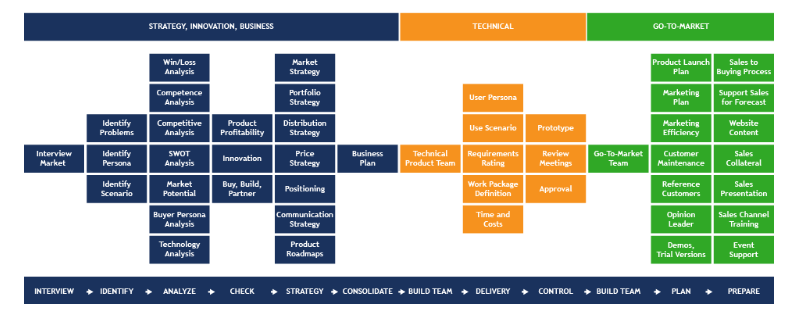

Defining KPIs can be learned in the Course "Strategic Product Management", according to the Open Product Management Workflow™.

Open Product Management Workflow™

- Course: Strategic Product Management

- Course: Technical Product Management

- Course: Successful Go-to-Market

Comparative figures and periods of time on which they are based are important. What is the value of the statement "We want to win 100 new customers"? Nothing, because in what period of time? Per day, per month, within the first 12 months? Where are these values compared to last month or year or compared to another product launch? Several data points must always be collected in order to set meaningful goals and make statements.

Sensible periods are months, quarters, years as well as for the measurement of the current status MTD (month to date), QTD (quarter to date), YTD (year to date). Comparisons are made monthly MoM (month over month) or yearly YoY (year over year). When comparing months, please note that due to seasonal fluctuations (Christmas business, summer slump, end of quarter) sometimes the comparison with the month of the previous year is more meaningful than the comparison with the previous month.

Some key performance indicators are then put into a ratio (variance, percentage of, growth), e.g.

- current value compared to target or forecast

- percent and deviation from absolute target or target corridor

- percentage growth

- compared to the same period of the previous year

- to the entire product portfolio

- to market growth

- to the competition

Correlations to existing market figures must often be formed due to a lack of market figures.

Assuming the statement "with the increase of domain registrations, the number of websites of micro-enterprises (1-10 employees) increases and thus the e-commerce turnover" is correct.

Only 10 years ago, there were no reliable statements on e-commerce sales, but the domain registrations were already recorded and known. Therefore, the growth of domain registrations could have been used as a benchmark for the increase in e-commerce sales at that time.

Conversely, this comparison no longer makes sense today, since e-commerce sales figures are available and at the same time new top-level domains (TLDs) mean that a single company can register several domains and therefore domain growth does not necessarily result in online sales growth.

After the described categorization of KPIs, dependencies between the individual KPIs should be identified and noted for analysis.

The data collection of the individual key figures is usually not done by product management alone. The product manager receives key performance indicators from controlling or product controlling, sales, marketing, development and support - if applicable, there is a business intelligence group in the company that manages BI systems and prepares, consolidates, aggregates or rebuilds the KPIs.

However, product management is responsible for bringing together the relevant key figures. Here, too, our experience is that primarily sales and cost key figures are recorded, but usually no product KPIs relating to quality, support and development are included.

Financial and corporate key figures are obtained from controlling. Often product management receives the (correct) sales figures from controlling, otherwise from sales or by direct access to appropriate CRM systems. Marketing and market key figures are available in Marketing & Communications. Market key figures only if the "competitive analysis" is also located in marketing.

Other product key figures are obtained from the areas of development, support, controlling or by correlating individual KPIs. For example, by combining average personnel and apportionment costs with the number of FTEs (Full Time Equivalents), the costs per support case can be determined. If important values are missing in controlling, product management must ensure that the essential KPIs are included.

Product management should discuss the overview of all key figures with the teams involved in a review meeting on a quarterly or at least semi-annual basis, after they have been consolidated by PM. In one, not in several separate meetings, so that each area also knows the successes and challenges of the other areas.

Sensorially, the display of consolidated KPIs contains a dashboard, but at least a traffic light system, "green" = KPIs are in or above the target, "yellow" KPI is 10% outside the target, "red" KPI is more than 10% outside the target corridor => measures must be initiated immediately or have already been initiated.

At the same time, a product manager, just like a good sales representative, should know his sales target, his forecast, his current result, know the KPIs relevant to product success and strategic goals so well that he can answer questions at any time and have the "success story" ready.

The question that a product manager should ask himself and must be able to answer at any time is: "What do I answer the managing director, the division manager - generally the top management - when he asks me during the joint ride in the elevator: "How is your product running?".

See the comments on "Elevator Pitch" in the article Key Performance Indicators (KPIs).

In our experience, PMs very rarely take care of the overall view, sometimes they don't feel responsible at all. In the worst case, the product managers are not even interested in these KPIs.

In the latter case we ask the product managers the question: "How do you want to optimize what you don't know" or "What are your decisions for the next strategic planning based on?".

To be fair, we must say that ignoring KPIs is rarely a holistic phenomenon. Individual KPIs are usually measured, but they are rarely strategically important.

Continue reading next article Part 3: KPI Examples and Explanations

Overview: More articles and information for product managers